Foregon started with the goal of helping Brazilians find better financial products through clear, detailed descriptions. It quickly evolved into a hub, offering free credit score checks and personalized recommendations. I was part of the team that developed the credit score feature, which became the platform’s core business model.

A credit score is a number that ranges from 0 to 1000 and reflects a person’s financial habits — like spending, bill payments, and overall financial health. It plays a huge role in whether banks approve or decline credit applications.

At Foregon, we noticed a pattern among our users: they were applying for financial products that didn’t match their credit scores, which led to rejections and worsened their financial situations.

Rejection for credit products can have a ripple effect on credit scores. As a precaution, some banks may lower scores after multiple rejections to mitigate risk, discouraging further applications for multiple credit products at the same time.

With this in mind, our goal became clear: create a supportive experience, giving users easy access to their credit scores and guiding them toward financial products that we knew would better fit their profiles.

Our team of seven (including the CEO, Product Manager, Tech Lead, developers, and myself as the Product Designer) took a content-first approach. Before diving into the design, we focused on understanding what information users really needed.

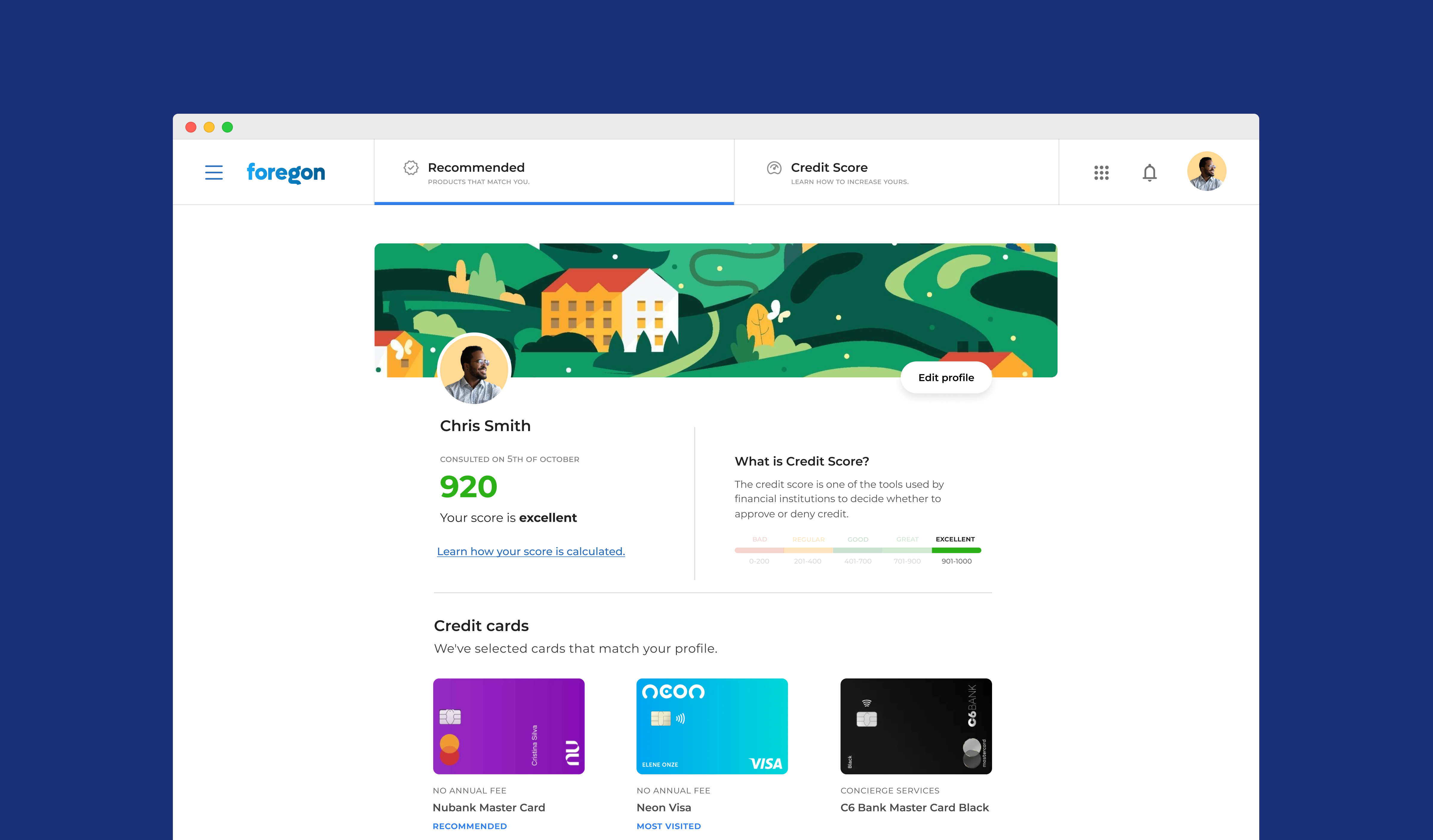

Through research, benchmarking, and design sprints, we shaped the product’s scope: a personal feed where users could easily see their credit score and financial products tailored to their score.

To empower even more, we had the idea of creating educational content with actionable tips to help users improve their credit and make better financial decisions. Our aim was to ensure the entire experience felt intuitive, helpful, and directly relevant to each user’s needs.

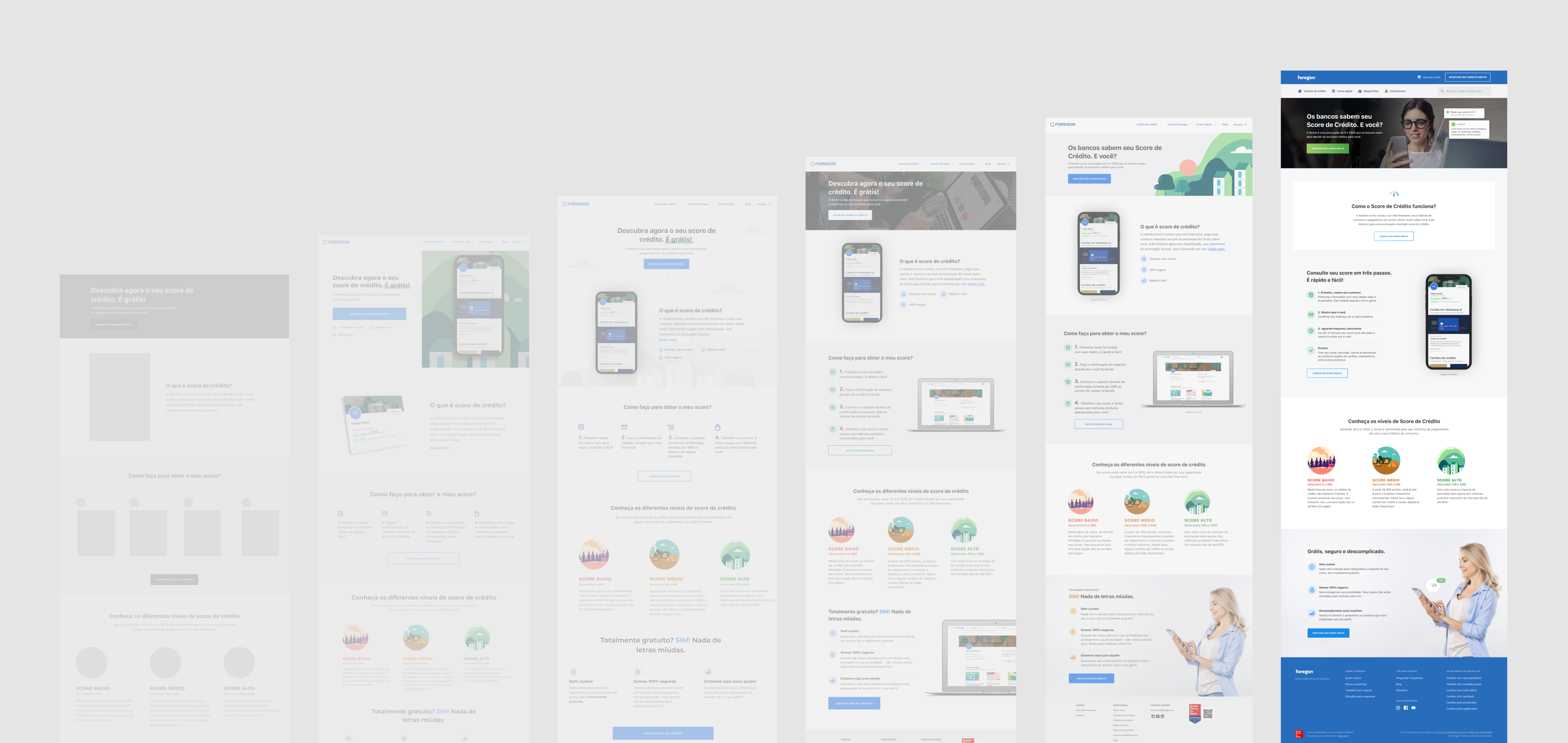

We started with research — benchmarking against competitors like ComparaOnline, Serasa Experian, and Nubank — to identify trends and gaps in the market. With these insights, we quickly moved to wireframing and testing low-fidelity concepts. This helped us iterate fast and refine the product based on user feedback.

Next, we created high-fidelity prototypes in Figma and ran usability tests with real users. We iterated the design and focused on exploring different concepts of product feeds that would dynamically show the best options for each user.

To ensure a smooth rollout, we implemented feature flagging, allowing us to test the product with different user groups and adjust in real time based on performance data.

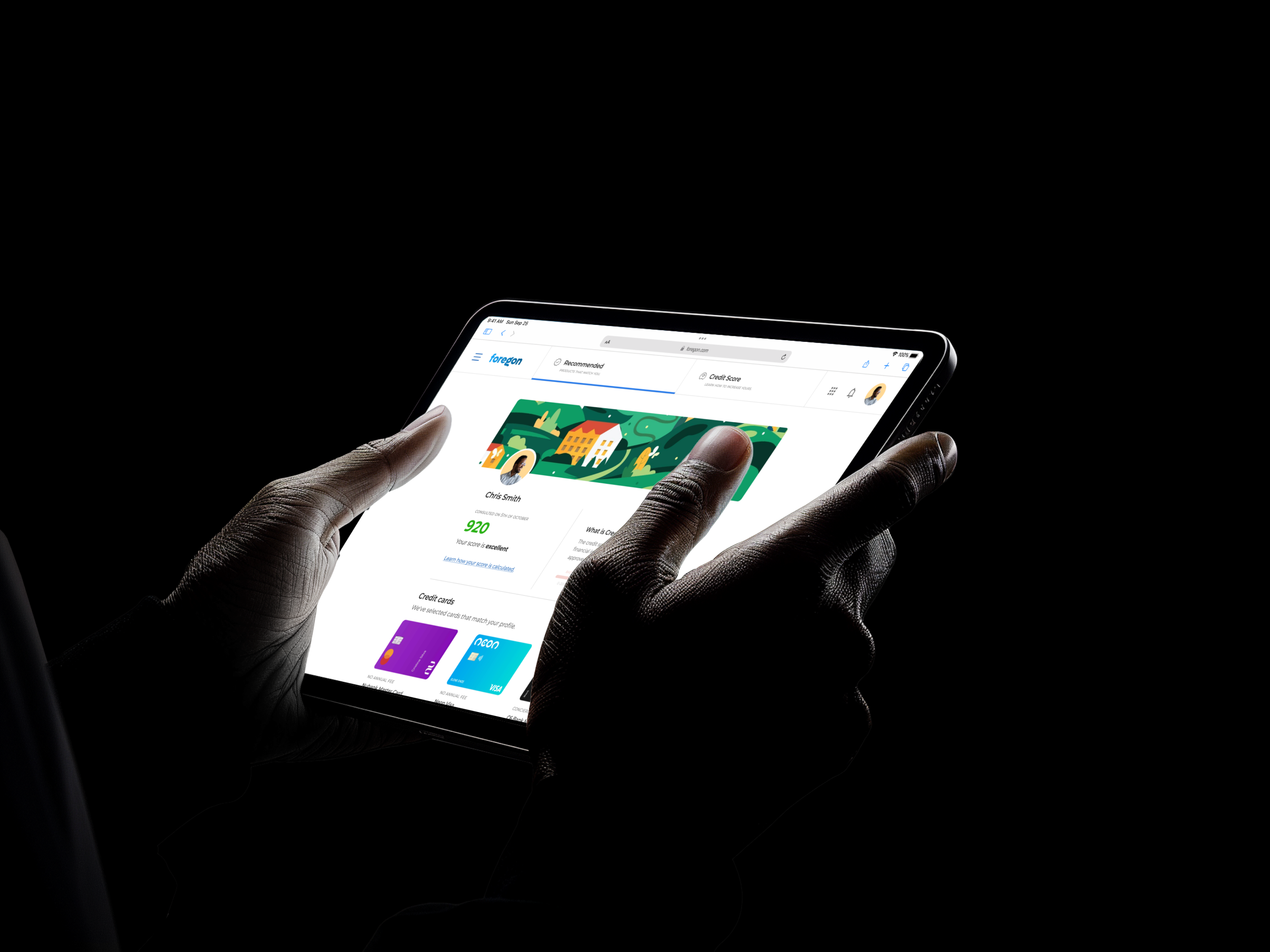

Within 3 months, we developed a product to help users manage their financial health by giving them easy access to their credit scores and personalized financial product recommendations, improving approval chances and simplifying decision-making.

We also added educational content to guide users on how to improve their credit scores, providing actionable tips to support better financial decisions.

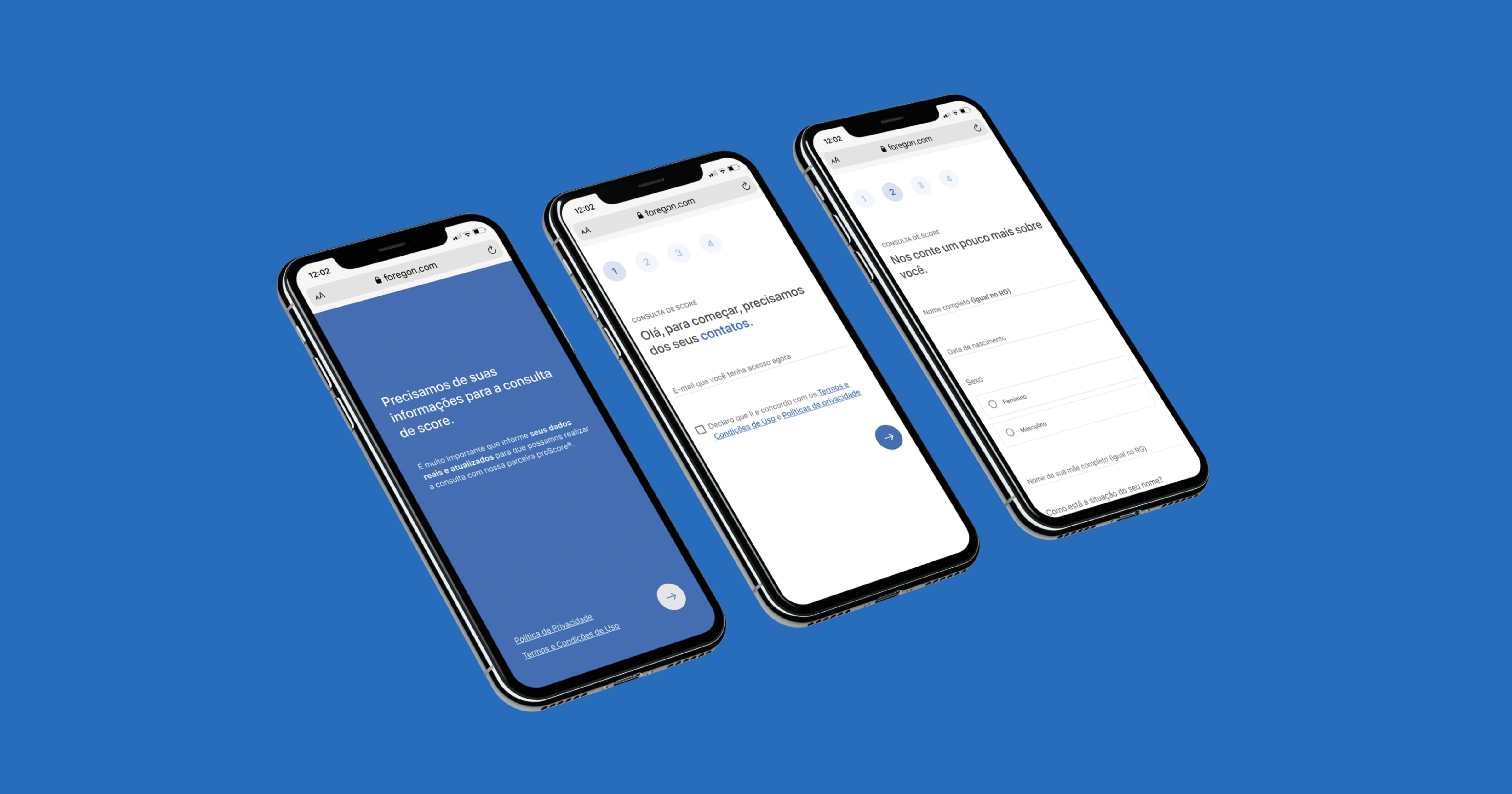

A landing page was designed to raise awareness, explaining the product’s value and encouraging sign-ups, making credit management more accessible and empowering for users.

15% increase in financial product redirects from the platform

8x higher retention among users who checked their credit score with us

1.6 million users impacted by the credit score product in 2019

450.000 new registered users, driven by the credit score feature

As a result, the credit score page became the most visited on the platform, driving engagement and conversions. The product went on to play a central role in Foregon’s business model, becoming a leading source of revenue and user growth.

This project not only improved the overall experience at Foregon but also helped establish the platform as a trusted go-to resource for credit scores and financial products in Brazil.